This post is by our regular Wednesday contributor, Erin. As young adults, I’m sure we’re all aware of the negative stigma surrounding living with our parents after graduating from college. When we’re faced with unemployment and poor job prospects on top of impending student loan payments, living back at home can make us feel like we’ve failed. […]

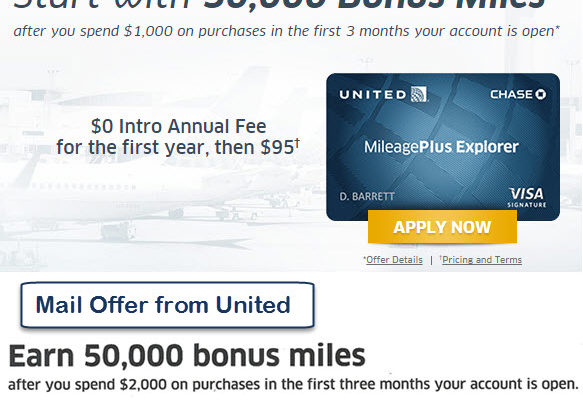

Read More >>Mail Credit Card Offers > Online Credit Card Offers

In a recent post I wrote about how you should always check your junk mail. My reason for telling people to check their junk mail was simple: you may be missing out on credit card offers that are (much) better than online credit card offers. You also likely won’t hear about these mail offers on […]

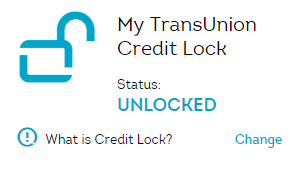

Read More >>A New Tool that Protects Your Credit: Credit Lock

The following is a paid review from TransUnion, but opinions are my own. Just last week we found out about a massive data breach at the second biggest health insurance company in the United States. Personal data – including social security numbers – of approximately 80 million employees and customers were stolen by a group […]

Read More >>How to Balance Debt Repayment and Saving

This post is from our regular contributor, Erin. Have you ever wondered which you should be focusing more on: debt repayment, or saving? Chances are, if you’re like many millennials who graduated with student loan debt, you’ve wrestled with this thought at one point or another. Knowing which to prioritize can be overwhelming at times. […]

Read More >>How to go to Vegas for Free

Today I will explain how you can go to Vegas for Free. Yes, free. Vegas is a great place to visit for a long weekend. Regardless of what your interests are, how old you are, or who you are travelling with, there is something for everyone. If you know what to do it’s absolutely possible […]

Read More >>How to Go On a Date Without Spending a Dime

This post is from our regular contributor, Erin. How many of you have felt stressed by the prospect of dating because of limited finances? You might be worried your car is too embarrassing to be seen in (or maybe you can’t even afford a car), that you can’t afford to go to an upscale restaurant, […]

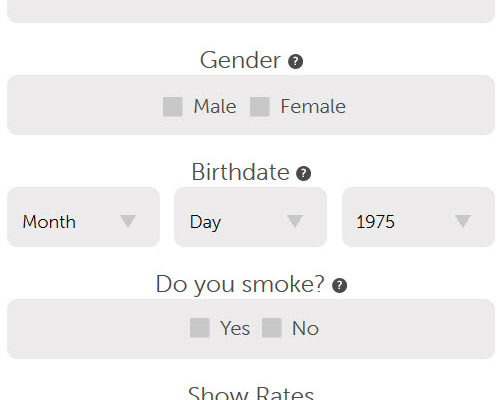

Read More >>The 1 Thing You Need to Do to Improve Your Finances this Year

If you are looking for Erin’s regular Wednesday post, it will appear on Friday this week. There are many things you can do to improve your finances, such as starting to invest, but today I want to focus on just 1 thing you need to do to improve your finances in 2015. You need to […]

Read More >>4 Ways to Use the Internet to Earn Money

Figuring out new ways to slim your budget and start saving more money is not necessarily that difficult. If you’re trying to conserve funds, there are plenty of routes to do that online. While not everyone is exactly a digital guru, these four steps to earning money on the internet don’t require a ton of […]

Read More >>How to Make Money on your Social Media Accounts

Are you one of the 284 million Twitter users or 300 million Instagram users? Did you know you can make money on your social media accounts? It’s true. There are people making money every day by posting tweets and Instagram photos that are sponsored by companies. You don’t have to have a huge following, either. […]

Read More >>Are Your Hobbies Costing You Too Much?

This post is from our regular Wednesday contributor, Erin. Do you know how much your hobbies are costing you on a yearly basis? If not, do you at least have a rough estimate? You might be wondering why this is important – after all, hobbies are often creative outlets, and they’re meant to be enjoyed! […]

Read More >>