This post is from our regular Wednesday contributor, Erin. Money and jealousy go hand in hand, don’t they? We often get caught up in what everyone else around us is doing with their money. What they’re spending on, what they can afford, and what we can’t afford. It’s a large reason why “Keeping Up with […]

Read More >>What To Do If You Are In Credit Card Debt

As much as we talk about investing, increasing income, and even travel hacking on the blog, it’s important to recognize the fact that many people’s finances revolve around one thing: credit card debt. Millions of Americans are in some form of debt. Debt can have a huge impact on quality of life, and is the […]

Read More >>How to Plan for Taxes for Side Income

A couple years ago I had my first sizable “side income” from blogging and freelance work. Unfortunately I also made an embarrassing, yet common, mistake: I didn’t plan for taxes appropriately. Needless to say I ended up owing the IRS a decent chunk of change come tax time. Ever since then I have been vigilant […]

Read More >>3 Ways to Make Your Living Situation More Affordable

This post is from our regular Wednesday contributor, Erin. When you pay the bills, do you ever wish your rent or mortgage was a bit more affordable? I’m willing to bet the thought has crossed your mind at least once. Living expenses always seem to take up the biggest chunk of our budget, don’t they? […]

Read More >>10 Productive Things to Do When Bored

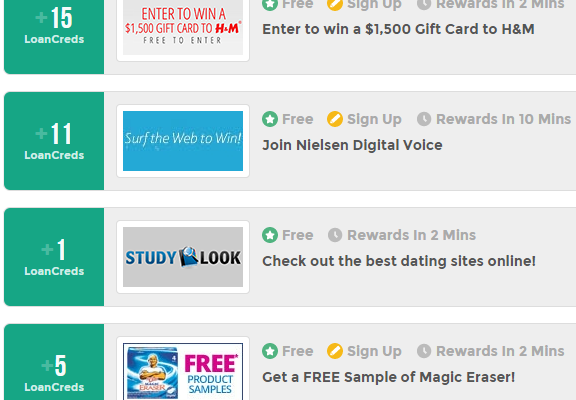

Boredom is inevitable. At some point or another, you will get bored. You can either waste time playing games and mindlessly scrolling through apps on your phone or you can make productive use of your time. Thankfully, being bored isn’t all that bad. It means you are likely open to doing just about anything to […]

Read More >>Gradible: Make Extra Money to Pay Off Student Loans

Because Young Adult Money focuses on the 20- and 30-something demographic, student loans are an important topic for us to address. After all, there is over $1 trillion in outstanding student loan debt held by more than 40 million Americans. I’m not a huge fan of writing about how people shouldn’t get in student loan […]

Read More >>How the Vision for My Dream House Changed and Why

This post is from our regular Wednesday contributor, Erin. When you were younger, did you have unrealistic expectations of what your future house would look like? Or did your dreams come crashing down once you knew how much of a mortgage you were approved for? Back in elementary school, I’d actually doodle floor plans for the grand […]

Read More >>Why Making Money is better than Saving Money

The two main topics we focus on at Young Adult Money are making money and saving money. Whether it’s explaining how to organize your coupons in an Excel Spreadsheet or how to save money shopping at Target, we are big advocates of saving money whenever possible. When push comes to shove, though, making money is […]

Read More >>How to Break into Personal Finance Freelance Writing

Hello Young Adult Money readers! This is Sarah from The Frugal Millionaire and today I’m going to be sharing how I got into personal finance writing and offer tips on how you can do the same. While no two freelancing careers are exactly alike, it’s always helpful to see how others got to where you […]

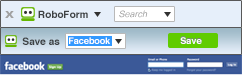

Read More >>How to Keep Your Passwords Secure

It seems like you need a password for everything today. It’s not unreasonable to have hundreds of different logins for various services and websites. The massive number of accounts and logins that people have today can lead to doing the one thing that can jeopardize all your accounts: using the same password for every website. […]

Read More >>