It’s not easy to build an emergency fund, but I have yet to meet someone who has said it wasn’t worth it.

I’ve said often that building an emergency fund was the best thing I’ve done for my finances, my relationship, and my mental health.

Again, it wasn’t easy.

My wife and I built our emergency fund through side hustles, saving money on groceries through couponing and meal planning, as well as increasing out 9-5 income.

We also made our emergency fund a priority over all our other financial goals. We had a ton of student loans and there was always “something else” that we could put our money towards (or in some cases needed to put our money towards).

In my book Student Loan Solution I interviewed Paulette Perhach, author of Welcome to the Writer’s Life, and she stressed the importance of an emergency fund. She actually refers to it as a “f*** off fund,” which may be a bit harsh for some people. But the underlying message is important: without money set aside, others have control over you.

Perhach explains an F off Fund like this:

A FoF is enough money to tell anyone who deserves to be told to f off to indeed do so. It’s the money you need to keep creepy or abusive people out of your life. Sadly, many of these people do an Academy Award-level job of acting nice or normal, until they realize they have power over you. If you have a FoF, you have more power over your own life, more autonomy to choose your circumstances, and more ability to say bye, or worse, to whomever you choose.

I believe that when you have an emergency fund, you have access to an emergency fund, you won’t put up with something that you think is wrong. Sure, this scenario may seem unlikely, but it happens every single day in the workplace.

I also think it’s easier to get motivated to build an emergency fund when you think of it in terms of an F Off Fund. Don’t you agree?

If you don’t have an emergency fund or want to bulk up the one you have, let’s go over how you can build an emergency fund $100 at a time.

Build your Emergency Fund $100 at a Time

Why $100? Well, for one the savings account I recommend you use to build this emergency fund requires $100 a month to receive their high interest rate (0.55% APY). But that’s not the only reason.

$100 is something that is enough money to make a difference while also not being out of reach for most people to come up with each month. You can make an extra $100 a few ways:

- “Find” Money in Your Budget – Whether it’s by cutting subscriptions, couponing when you go grocery shopping, brewing coffee at home, or some other savings strategy, most people can find $100 in their monthly budget.

- Side Hustle – Some people may be able to get a pay bump at work, but many are not able to. If you are “maxed out” at your 9-5, consider starting a side hustle to gain some additional cash flow. $100 a month is relatively easy to get through a side hustle. For example, my wife pet sits from time-to-time and could make $100 with just 3-4 days of watching a dog or dogs.

- Redirect Cash Flow – I hate to say this because most of the time investing or paying down debt is a good choice, but if you are paying extra towards debt or putting a certain percentage towards investment accounts each month or each paycheck, consider redirecting that cash flow towards your emergency fund. (Don’t worry, once your emergency fund is at a good spot you can redirect your cash flow back to these things)

I totally understand that for some people $100 a month is difficult. But I do think that for most people it’s realistic to set aside $100.

And $100 will add up over time.

I recommend using CIT Bank’s savings account when you are building your emergency fund (and once you have one built) because they have one of the highest interest rates available. There may be a few select credit unions with a higher interest rate, but as far as banks go it will be tough to find an account with this good of a rate.

I actually was beating myself up recently for leaving my emergency fund parked in a TCF savings account. I was missing out on hundreds in interest each year! I now have my emergency fund parked in a CIT savings account.

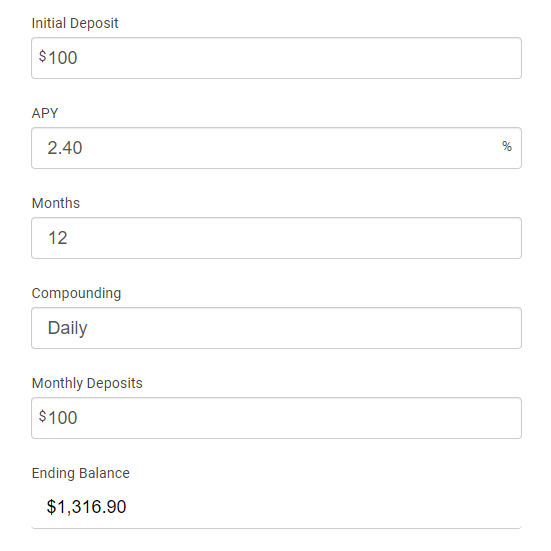

Let’s say you start with a $100 initial deposit and deposit $100 a month, every month, for twelve months. Here’s where you would be a year from now:

Note: The example below uses a 2.40% interest rate. Over the past year, the Federal Reserve has continued to cut their interest rate lower and lower, causing CIT Bank and other banks and credit unions to lower the interest offered. Virtually every bank has been shifting their rates lower and lower as the Fed has kept interest rates low. CIT Bank currently offers 0.55%, which is one of the highest rates you will find today.

After 12 months you would have $1,316.90. Not a bad emergency fund, and much more than the average American. That means you made about $17 just by choosing a high interest savings account.

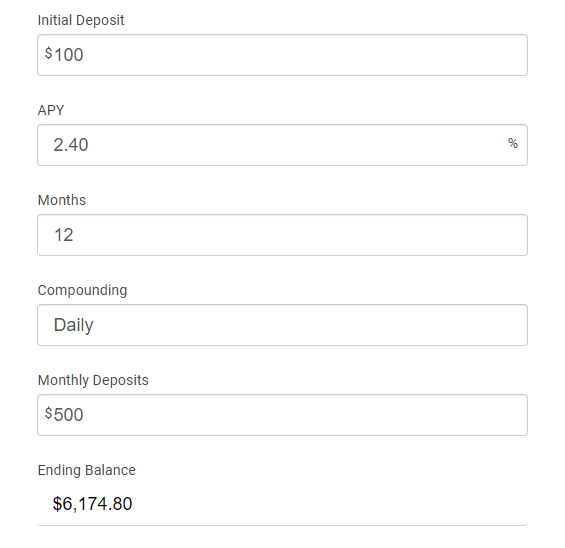

You may be thinking $1,317 isn’t enough. Well let’s up the ante and start with $100 opening deposit, but add $500 a month for twelve months. Here’s where you would be at after a year:

$6,174.80! And $74.80 of that was simply through interest.

The story here is that interest keeps building over time, so the sooner you build an emergency fund the sooner you that money can build over time.

There is one thing to keep in mind with the CIT Bank savings account I referenced earlier. To get the 0.55% APY, you need to either deposit $100 a month or have a $25,000 balance. That’s why I recommend consistently depositing an additional $100 a month (or more).

Building an emergency fund was a game-changer for me. Sure, I still get stressed about finances, but at least I know I have a pile of cash to fall back on if I need it. I don’t think you’ll regret making an emergency fund a priority in your life.

Agree when I started to have a budget to respect I understood the importance of savings and emergency fund, now I’m into Savvy mood for important goals to achieve in the next 3 years and I choose to deposit every month a determined amount into an account…but also with a budget I hang out with friends, do shopping, read books and other…planning is really deal to be and stay focused and organized-at least for me-

Agree 100% that you want to have an emergency fund, F*** Off fund, cash on hand, or whatever phrase motivates you to have access to money when you need it. I also use CIT, and so far it’s been great. We are on the older end of Gen X, so not just building up our initial accounts, and another thing we use is a line against our real estate. Now we can do this b/c we have equity built up and we know we’re good with debt (we have used our line to purchase more real estate or other investments, not consumption). It isn’t a strategy for everyone, but it is another emergency fund.