Many hedge fund and mutual fund managers spend most of their day analyzing companies with the ultimate goal of picking winners and losers.

Many hedge fund and mutual fund managers spend most of their day analyzing companies with the ultimate goal of picking winners and losers.

Oftentimes that involves taking positions in companies that they think have an edge over their competition. They base these decisions on massive amounts of quantitative and qualitative data.

This raises a question for regular investors, though: should you invest in a company or an industry?

With so many ETFs to choose from and the ability to create your own “mutual fund” through Motif Investing, it has become very easy for regular investors to take stakes in entire industries for very small fees; you can invest in up to 30 companies for just $9.95 at Motif Investing.

Investing in a single company is much different than investing in an entire industry. When you invest in an industry you are expecting the industry as a whole to grow, regardless of which companies win or lose. When you invest in a single company you are expecting that company to outperform competitors and gain market share.

Advantages of investing in an industry

If an investor believes that an industry is going to grow over time, it might make sense to invest in the entire industry instead of trying to pick winners and losers within the industry. This is the same logic used to promote investing in index funds instead of individual companies.

I think a great example of where it makes sense to invest in an entire industry is the health insurance industry. Health Care Reform – or “Obamacare” as most like to call it – changed the health insurance industry. While there were some regulations that hurt the industry such as the MLR ratio, it also mandated that millions who are not currently insured will be able to get insurance.

Not only is health insurance mandated, but the way the law was set up in a way that insurers will profit due to risk-sharing and other things included in the law. Simply put, we can be fairly comfortable that we will see growth over the next 1-10 years in the health insurance industry. And I didn’t even mention all the ways health insurance companies are diversifying their revenue streams!

Instead of trying to pick which of the major companies is going to grow the most over the next 1-10 years, I think it makes a lot of sense for investors to get exposure to the industry as a whole. There are things that each company is doing well and things that each company can improve. What we do know is that the industry is likely to grow as more and more people sign up for health insurance.

(For full disclosure, I do work in the health insurance industry and own positions in health insurance companies).

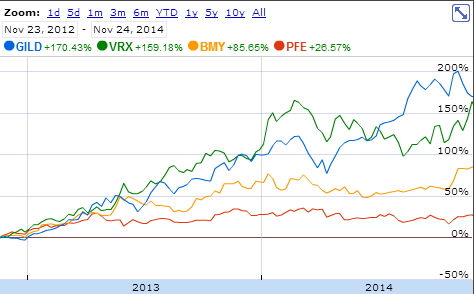

I think another example of an industry where it makes more sense to get exposure to the industry as a whole instead of individual companies is the pharmaceutical industry. Most people have heard of Gilead Sciences recent breakthrough drug sovaldi. Sovaldi is the most successful Hepatitis C drug ever and Gilead Sciences charges $84,000 for the 12-week’s worth of pills that need to be taken for the drug to be effective.

In the pharmaceutical industry it can be difficult to predict what treatments companies are going to develop. What if 2 years ago you had invested in one of the other pharmaceutical companies instead of Gilead and missed out on some of their recent gains?

Sure, you might have picked a company that did “okay,” but wouldn’t you have been better off if you had exposure to the industry as a whole instead of trying to predict which company will grow faster than the others? I think so.

When should you invest in an individual company?

One of the biggest difficulties with individual stock investing is that there are professionals who spend all day trying to pick companies that are going to outperform the market. It’s their full-time job to pick winners and losers. Problem is, they aren’t always successful. It’s difficult to pick companies that will outperform their industry, let alone the stock market as a whole.

With that being said, there is definitely a higher likelihood of abnormal gains if you are willing to take on the risk that comes with investing in individual companies. If you are willing to take on that risk for the chance of high gains, it very well could make sense to pick a handful of companies you believe will outperform their peers.

I personally think the average investor is more conservative than most think. Index funds and ETFs are good options for most “regular” investors for a variety of reasons. I already mentioned them earlier, but I really have enjoyed Motif Investing. I think I’m pretty up-to-date on business and economic news, so being able to put together my own sort of “mutual fund” of up to 30 stocks is a very attractive investing option.

To answer the question this post is based on, I think that investing in an industry is better than investing in individual stocks.

What are your thoughts on investing in a single company versus investing in an entire industry?

____________

Photo by Garrett

I have to admit that I know that I will be always be nervous about investing my money and will most likely rely on a professional to makes the decisions such as this for me. I realize that it is so important now to get educated on issues such as this and I really appreciate the info. When you talk about investors being conservative there is no doubt you are talking about me.

Debtfreemartini There is certainly nothing wrong with relying on professionals when it comes to investing. I think it’s great that you’ve realized the fact that you are a conservative investor.

I like how you phrased the topic by asking this question. By doing so, it means looking at the issue from a different angle. I think that it depends on how much of a hobby you’re willing to make investing. If you are committed to learning about investing and putting in the time when it comes to learning about individual companies, then I think it makes sense. But if you’re a casual investor, following an industry is a safer bet.

I like the idea of investing in an industry vs. investing in a specific company. Honestly, we buy index funds and hold forever. Our investing strategy is incredibly boring.

Holly at ClubThrifty It’s not a bad way to go. Index funds are definitely the “safest” approach to investing and gives fairly consistent increases. My only concern is when people are 100% exposed to US companies through index funds and do not have any exposure to overseas markets.

Typically companies in the same industry will move in tandem with each other so if JP Morgan has bad earnings, the banking industry will do poorly overall. That being said, I would rather own the industry than the company because even if they move in tandem, each individual company will not move quite as dramatically as one on it’s own. Meaning JPM will swing the most on bad earnings while Citibank, Wells Fargo and Bank of America won’t move as much.

theFinancegirl Thanks, I think sometimes it’s easier to start a blog post with a question. A lot of people talk about diversifying investments across a plethora of individual companies, but I think there is so much variance in companies and industries that it might make more sense to invest in an entire industry versus getting on board with one company.

blonde_finance You raise a good point and I’ve definitely seen companies in the health insurance industry move in tandem. At the same time, some companies may grab market share from other companies within it’s industry making it a bit tougher to make sure you are guarded from that risk if you are invested in only one company.

Good question! I can go either way and do both but tend to lean more towards the industry, especially when you can focus on an industry within an ETF – much for the reason Shannon stated. As to if the average investor is more conservative than most think…I didn’t speak with any of them in my day job. ;)

I’ve been considering investing in the 3-D printers, but wasn’t sure which companies to invest in. I need to research what my options are and if there is a fund that encompasses several in the industry.

I agree with you, DC. Most all of our investments are in industries as opposed to individual companies, with the exception of a few tried and true companies with a long-term (i.e., several decade) history of stability.

I’m not sophisticated enough to pick individual stocks, but I wanted to be involved in investing. It’s index funds for me all the way!

Industry stocks may be smarter, but talking about how your individual stocks are performing makes you sound really cool at cocktail parties.

FrugalRules Haha yes I suppose you had more exposure to everyday investors in your day job than pretty much anyone I know. I like the idea of going more specific within a sector – i.e. Health Care – than an ETF allows. I also sometimes like the fact that in Motif you could exclude a few companies that you really think aren’t going anywhere…granted that could bite you in the end as well.

brokeandbeau That’s an interesting industry, and I’m curious how high investors have pushed prices on those stocks. It would be cool to find or make a motif of those stocks.

Laurie TheFrugalFarmer Good to hear, Laurie! I think the health care sector really opened my eyes to the chance of getting burned on any one company (especially pharmaceuticals). You never know what company will develop what drug first.

pfjenna That’s not a bad way to go, Jenna. Better to invest in index funds than try to invest in individual companies without researching them thoroughly.

Mark@BareBudgetGuy Haha yes, but you could still learn about individual stocks within an industry without investing JUST in those individual stocks ;)

Generally speaking, I’m not a huge fan of picking companies because it is so high risk and most people who say they are high risk investors really aren’t. Especially when they start losing money. :) I do think individual stocks can have their place in a portfolio, but most average investors won’t do the research. They choose a company because the name is irresistible (Facebook) or because someone told them they made a killing.

ShannonRyan I agree that a lot of individual investing is based on “hot tips” or some other piece of information that they believe can cause a stock to go high in the short-term. I don’t think most people are ready to deal with the potential negative effects, though, such as a stock DROPPING when the hot tip doesn’t work out. One example I can think of is the FDA approving/disapproving a certain drug.

I like the idea behind Motif. I just haven’t had enough time to study and see if that strategy is better than what I’m currently doing. I would probably never invest in a single company, although I did buy some Disney stock when my daughter started getting into all things princess!

I can see some real benefits in taking an industry level view to investing, and using ETFs or Motifs to achieve this. If you take a ‘top down’ approach and are happy looking at broader macro trends then it’s a great way to go. I personally like the ‘bottom up’ approach – I don’t love staying up to date with all the global trends and trying to figure out which industry will outperform, but I do love hunting for value in individual businesses. Not to say it’s the ‘better’ way, but it’s what works for me.

Eyesonthedollar Haha well Disney seems to be a very solid company to invest in. It’s amazing how much they made off of “Frozen” alone.

Jason@Islands of Investing You make a good point that it really depends on whether you want to invest in high-level trends or try to find value within a group of businesses. I think either approach is effective but I think for me personally the top down approach is the best way to go.