I talked about what a great tool FeeX is in the past, but until recently their service (which is 100% free) was only compatible with IRAs.

I talked about what a great tool FeeX is in the past, but until recently their service (which is 100% free) was only compatible with IRAs.

While it’s great that they can scan IRAs and tell you how much you are losing paying in fees, it doesn’t do much good to people like me who don’t have an IRA.

I recently received some great news: FeeX no longer is solely for IRAs! FeeX upgraded their service and they now have the ability to scan 401(k), 403(b), 457, and brokerage accounts.

Because I prescribe to a “set it and forget it” approach when it comes to my retirement accounts, I don’t switch up my asset allocation very often. In fact, it’s been well over a year since I changed my asset allocation. I would have little to no idea if I was losing money due to unreasonably high fees.

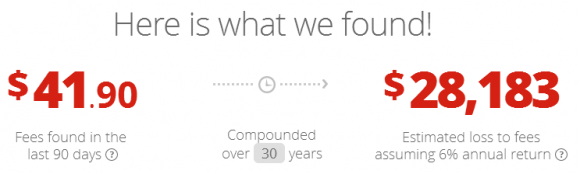

So I headed over to FeeX and quickly linked my Fidelity 401(k) account. Here is what FeeX found:

So I had $41.90 in fees the last 90 days, and my estimated losses over 30 years (assuming 6% annual return) is $28,183. If you didn’t know why fees matter before, you do now!

FeeX doesn’t stop there. It breaks out each of the fees and then lets you know if there are similar funds with lower fees. For mine there was none.

FeeX didn’t just upgrade the types of accounts they support, they also upgraded the number of fees their tool identifies. They used to only identify expense ratio fees. In addition to expense ratio fees they now find all the following fees:

- Advisory

- Wrap

- Transaction

- Maintenance

- Front-load

- Back-end

Who knew there were so many fees??

When I looked at the breakout of fees for my 401(k), I saw that there were some recordkeeping fees.

Now, recordkeeping is a necessary function of any fund, so I can’t blame them for that. What I found interesting is the button to the right of it that says “Reduce Fee.” If you hover over it, a “Coming Soon” icon shows up. Considering how much functionality they added in this latest upgrade, I can only imagine what they have planned for future upgrades.

You may be thinking that fees are small potatoes. I thought so too, until I saw how much I’m losing in fees over time, as well as this shocking statistics:

70% of Americans believe their retirement account doesn’t have fees…but Americans paid $43 billion in IRA investment fees last year alone!

Source: 2013 Investment company factbook (ICI)

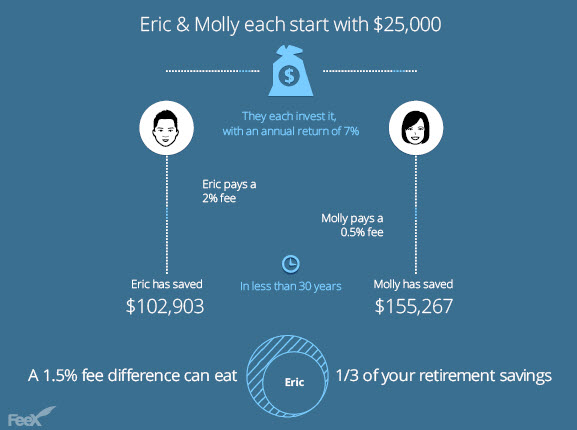

Crazy stuff! I also think nothing does a better job of showing why fees matter than this graphic:

A 33% difference in savings (over $50k in this example) because of a 1.5% fee difference. That’s a HUGE difference! I don’t know about you, but losing 50k would be a big deal to me, especially if we’re talking about retirement (and something as simple as investment fees).

If you haven’t already, head over to FeeX and see what fees you are being charged in your retirement account. While you’re at it, see if there are cheaper options – it could save you thousands of dollars!

How much do you pay in fees on your retirement accounts? What? You don’t know? Head over to FeeX now!

Seriously though, have you ever looked into the fees you are paying on your accounts? How often do you change your asset allocation in your retirement accounts?

That is insane! Another reason to go with a low-cost organization like Vanguard! My accounts have the lowest fees out there and I’m glad they won’t be chipping away at my retirement quite this much =)

Holly at ClubThrifty I’ve been looking into Vanguard funds as a way to invest some money in my individual trading accounts. I really like the options they have and the low fees are a big positive.

Yep, I saw this all the time when I was working in the brokerage industry. Many either didn’t realize it or even care. The sad fact is they’re not looking at the long term impact. That’s also not to mention the fact they’re paying some exorbitant fee so someone can get a paycheck when they could likely do better with something lower in cost or passive.

DC @ Young Adult Money Holly at ClubThrifty Yes, I’m with Holly…Vanguard is excellent and both their index funds and actively managed funds have very low fees. Fees matter!

FrugalRules Great advice, John, and you have a lot more insight than most people into this. The industry seems to take advantage of the fact that most people don’t think about fees, especially not ones that seem small on paper.

Andrew LivingRichCheaply DC @ Young Adult Money Holly at ClubThrifty I wish Vanguard was available in my 401k, but unfortunately they are not. There are some comparable funds, though.